Economic & Market Overview

Due to strong employment growth and commodity prices, a vastly better fiscal position this year’s Federal Government Budget provides a margin of safety for the government to increase expenditure. $14.6B has been committed to cost-of-living relief measures, including energy rebates, Medicare rebates and a boost to Jobseeker forming the centrepiece of the government’s plan to insulate the economy against a backdrop of declining growth and elevated inflation.

Three core principles guide this year’s Budget. Firstly, to offset cost-of-living pressure for the vulnerable. Second, spending restraint in key categories health and social security. And third to reprioritise long-term spending in infrastructure and defence.

Measures are targeted towards low-income households to weather the effects of inflation. However, there is no meaningful attempt to tackle structural pressures from NDIS, aged care and healthcare which has seen growth outpace inflation over the past few years.

With this government needing to stamp their economic credibility, we think this Budget represents a step in the right direction. Given the RBA has its sights set on reducing demand (via monetary policy), fiscal policy will need to provide immediate support if the economy stutters. In summary, the measures announced broadly support equity market sentiment.

Inflation remains the biggest issue facing the Australian Economy. Increases in investment, and subsequent increases in productivity allow the prices of goods to fall and are required to dampen inflation.

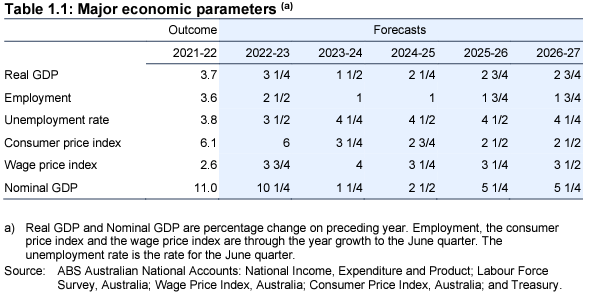

- Treasury is not forecasting a recession for Australia. Treasury expects growth to fall to 1.5% in 2023-24. Growth slightly recovers to 2.25% in 2024-25. This is the soft landing the RBA is looking for (and many Australians are hoping for).

- Slowing employment growth leads to a rising unemployment rate. This is particularly relevant as NAIRU (Non-Accelerating Inflation Rate of Unemployment) is estimated to be 4.00% – 4.25% NAIRU is not readily observable in real time, but as unemployment rises, real wages growth, and subsequently inflation, are forecast to decline.

Source: The Commonwealth of Australia

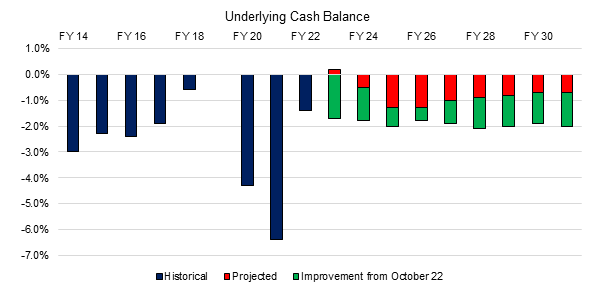

The notable achievement is a return to a balanced budget. The budget is expected to be in surplus in 2022 – 23 by $4.19 Bn (Last year the Australian economy had total output of $2,449bn – this means that his surplus was 0.17% of GDP). This was largely a result of exploding revenues from commodity exports producing the best terms of trade in Australia’s history.

It is the improving terms of trade that allow the budget balance to shift upwards in the budget for 2023-24, compared to the budget for October 2022-23. This improvement is caused largely by global market conditions, but we should take good luck when we can get it.

Based on Commonwealth of Australia data

Deficits are forecast to return from next year as the terms of trade retreats from its apex. We believe that there may be more resilience in commodity process, and there is potential for another surplus, or at least smaller deficits in the short term.

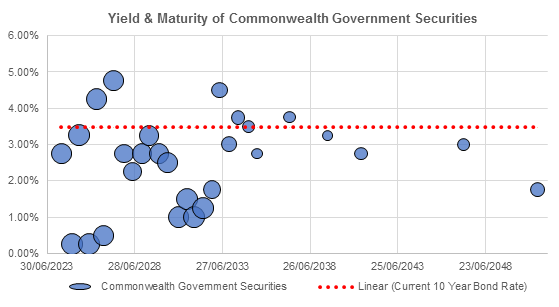

This impacts the level of debt forecast and future interest expense. The weighted average yield on securities that mature in the next 10 years is 2.23%. If this debt was refinanced at the current 10 year bond rate, this would imply an increase of 50% in our interest bill, without any increase in debt levels. However, rising debt is an outcome of this year’s budget, the capacity for the economy to absorb higher interest repayments will be tested over the next few years if employment conditions or commodity prices end up less favourable.

Based on Commonwealth of Australia data, iress.

Treasury’s forecast for gross debt rises from A$923b in 2023-24 (35.8% of GDP) to A$1,067b in 2026-27 (36.5% of GDP). However, Australia’s fiscal position remains in much better shape than global peers. This leaves some dry powder should current economic conditions deteriorate. This Budget also allows Australia to retain its AAA credit rating.

Few consumption levers pulled in this Budget.

Features of previous Labor Budgets such as one-off cash payments, big increases to welfare and tax offsets were notably absent. Instead, big spending programs were replaced by targeted relief to jobseekers and low-medium income households.

Unfortunately, this budget does not provide a stimulus to retailers as in the past few years, but equally, targeted support to the vulnerable should also limit the downside risks to consumption.

Incrementally positive for equity markets.

Overall, some fiscal restraint, targeted spending, and measures to address workforce participation should provide investors’ confidence that the government is taking a safe approach to managing the budget.

Importantly for the market, a small surplus and few inflation-inducing spending measures should also reassure investors that a slowdown is possible without making abrupt changes to fiscal policy. We see support for the AUD as the fiscal position remains stronger than peers despite the incremental step-up in fiscal spend. Likely modest increases in the RBA cash rate will also likely result in a stronger AUD.

What does all this mean?

The Budget reinforces our view that fiscal support will not be withdrawn hastily. However, the government still lacks the determination to bring about significant structural reform, chiefly around productivity, the environment and innovation. A lack of genuine long-term reform has been an unfortunate feature of recent budgets.

In our view, the budget is unlikely to bring about significant revisions to corporate earnings, however the ongoing commitment to support the vulnerable parts of the economy while also demonstrating some fiscal restraint will underpin market sentiment and support earnings confidence. Resources, Energy and Financials have benefitted from resilient economic activity and the inflation dynamics.

Household balance sheets remain in good shape which should continue to support consumption. We also see upside risk to dividends if economic conditions hold. We prefer a targeted portfolio approach favouring quality (strong cashflow and market position), sectors linked to higher inflation (Energy, Resources) and select cyclicals.

Wealth Management

The constant chatter earlier this year in relation to a proposed raft of superannuation and tax changes mercifully quietened in the weeks before this year’s Federal Budget. All in all, it was a very low-key Budget in respect to wealth management matters.

Superannuation

From 1 July 2026, employers will be required to pay their employees’ super at the same time they pay their wages, thus enabling employees to track their entitlements to make sure super contributions are being paid on time and in full.

An investment of $27 million is also being set aside in 2023-24 for the ATO to improve data capabilities, including matching both employers and super fund data at scale. A further $13.2 million will also be available to the ATO to consult and co-design a new ATO compliance system which will proactively identify instances of under or unpaid super in near-real time.

From 1 July 25, under the previously announced “Better Targeted Superannuation Concessions” proposal, earnings on balances exceeding $3 million will attract an increased concessional tax rate of 30%. Earnings on balances below $3 million will continue to be taxed at the concessional rate of 15%.

There was no mention in the Budget papers that the $3 million threshold will be indexed, nor does it address other contentious matters raised during the consultation period such as taxing unrealised gains. (The Budget papers allude to a ‘valuation method’ for defined benefit pensions but details are yet to be released.)

While not a budget measure, the Transfer Balance Cap threshold will index to $1.9 million on 1 July 2023. Similarly, the Total Super Balance limit will index to $1.9 million on 30 June 2023 due to CPI indexation.

There was no mention of the 50% reduction in minimum pension factors continuing beyond this financial year so it is highly likely the minimum percentage factors will return to normal from 1 July 2023.

Small Business

Businesses with annual turnover of less than $50 million will have access to a bonus 20% tax deduction for eligible assets supporting electrification and more efficient use of energy, from 1 July 2023 until 30 June 2024 (i.e. a total deduction of 120%).

Up to $100,000 of total expenditure will be eligible for the incentive. Assets that support electrification include heat pumps, electric heating or cooling systems, batteries, or thermal energy storage.

Eligible small businesses will also be provided with cashflow relief by halving the increase in their quarterly tax instalments for GST and income tax in 2023-24. Instalments will only increase by 6% instead of 12%.

Businesses with a turnover of $10 million per year will be able to temporarily increase the instant asset write-off asset threshold to $20,000 between 1 July 2023 and 30 June 2024.

Home Ownership

Eligibility for the First Home Guarantee and Regional First Home Guarantee will be expanded to any 2 eligible borrowers beyond married and de facto couples, and non-first home buyers who have not owned a property in Australia in the preceding 10 years.

Australian Permanent Residents, in addition to Australian citizens, will be eligible for the Home Guarantee Scheme.

Welfare Recipients

In September, eligible single parents will receive Parenting Payment (Single) until their youngest child turns 14. The current cut off age is 8 years old. The current base rate of Parenting Payment (Single) is $922.10 per fortnight. This compares to the JobSeeker Payment base rate of $745.20 per fortnight. This equates to an additional $176.90 per fortnight payment for a single parent up to when their youngest child reaches 14 years of age.

Eligible singe parents with one child will be able to earn an extra $569.10 per fortnight, plus an extra $24.60 per additional child before their payment stops.

The base rate payments of JobSeeker, Austudy and Youth Allowance and rent assistance will increase by $40 per fortnight to eligible people. A higher rate of JobSeeker will also be available to recipients aged 55 years and over who have received the payment for 9 or more continuous months (currently applicable to those 60 and over). Payments will continue to automatically index to reflect changes in consumer prices.

The maximum rates of Commonwealth Rent Assistance will increase by 15%. This works out to be $31 per head per fortnight.

Aged Care

An interim increase of 15% to modern award wages will be allocated for many aged care workers. As stated in the Budget papers, personal care and support workers earn $34 per hour on average, which is about 25% less than the average worker.

An investment of $166.8 million will also be provided to support older Australians who wish to remain at home for longer, providing an additional 9,500 home care packages. Increased funding will also be made available to deliver aged care services to Aboriginal and Torres Strait Islander Elders, enabling them to remain connected to their communities.

Paid Parental Leave Scheme

From 1 July 2023, Parental Leave Pay and Dad & Partner Pay will combine into a single 20-week payment. A new family income test of $350,000 per annum will be introduced. The Government is also committed to increasing Paid Parental Leave to 26 weeks by 2026.

Taxation

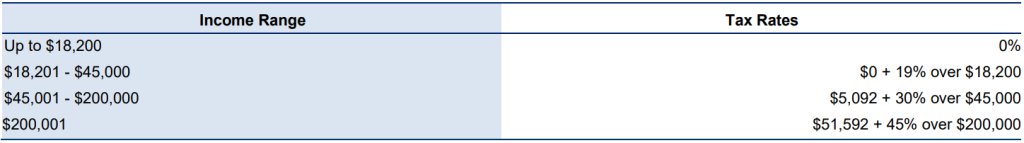

The planned Stage Three tax cuts are on track to commence on 1 July 2024. This includes raising the upper threshold for the 30% tax rate from $120,000 to $200,000 and removing the 37.5% tax band completely.

Proposed 2024/25 Marginal Tax Rates

Source: The Commonwealth of Australia

The low to middle income tax offset (LMITO) looks set to end this financial year, as previously indicated by the Treasurer in earlier preBudget interviews. There had been no plan to continue this tax offset beyond the 2022-23 year.

Sources:

The Commonwealth of Australia, Budget 2023 – 24, Budget Papers No. 1 -4

Michael Knox, Morgans Financial, Economic Strategy – Chalmers Delivers on Government Services.

Andrew Tang, Morgans Financial, Equity Strategy – Walking the Fiscal Tightrope

Terri Bradford, Morgans Financial, Federal Budget 2023

Disclaimer: The information contained in this report is provided to you by Morgans Financial Limited as general advice only and is made without consideration of an individual’s relevant personal circumstances. Morgans Financial Limited ABN 49 010 669 726, its related bodies corporate, directors and officers, employees, authorised representatives, and agents (“Morgans”) do not accept any liability for any loss or damage arising from or in connection with any action taken or not taken on the basis of information contained in this report, or for any errors or omissions contained within. It is recommended that any persons who wish to act upon this report consult with their Morgans investment adviser before doing so.